Yes - you need both

Our short answer is yes.

Credit limits should be set in every business and, more importantly, enforced. It may not be completely necessary to set them for all of your customers, but certainly the majority of your turnover should be covered by credit limits.

Although there is a lot of crossover between credit limits and credit terms, they both work best, when used together.

You need both because they serve different purposes when it comes to managing your business' cash flow and total risk.

Credit terms are about getting paid what you are owed on time. And there are various ways that you can improve your collection, as we covered in our blog, Improving small business cash flow.

Credit limits are about limiting the amount that you are prepared to lend to your customers. And that is absolutely the way to think about it - your customers are borrowing money from you - money that you may, in turn, be borrowing from your bank.

If you trade, based on 30 day terms, typically you will get paid on around day 47. If your business' financial model can accommodate this, then all well and good.

But if the maximum amount your business can afford to finance in outstanding invoices at any time is, say £50,000, getting paid on 47 days becomes less relevant if a customer is running a £55,000 tab.

How to set business credit limits

As mentioned above, credit limits are about limiting the amount of money you can lend to your customers, so setting credit limits has to start internally, which is where many businesses go wrong.

Most owner managed businesses will set credit limits based on external factors, such as credit checks, customer net worth or by securing trade credit references. But all of these are focused on the customer, not your own business.

They are all important factors in deciding how much credit any one customer should be granted, but the first task is to establish how much, in total, your business can put at risk.

This is part judgement call and part calculation. But you should start with the calculation and then adjust the numbers for the commercial risk element.

Looking at the working capital requirement for your business, over the short and medium term, will allow you to arrive at a number. There are various ways to look at working capital but, essentially, you want to know how much ‘free cash’ you need in the business to meet your bills.

It is a blend of your bank position (including any structured financing), how much credit your suppliers permit you, how much you need to hold in stocks and/or work in progress and then the big ‘known’ bills such as payroll and rent.

You should be able to calculate how much, in total, you can allow customers to borrow from you.

If you sit back and decide it’s not enough, then you have to work out how you will change the numbers with your suppliers and bank, etc., in order to allow your customer lending to increase.

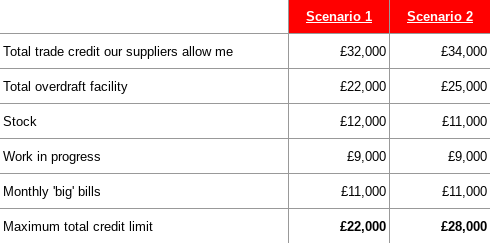

The below shows how small increases in the credit terms you receive and bank overdraft, coupled with a small reduction in the amount of stock held can increase the total credit limit you can grant to your customers:

Calculating working capital can be a complicated process and the above is a somewhat oversimplified approach, but the principle is sound - work out what you can afford to lend first. Don't guess.

This is your starter for ten, but at least that starting number is based on a financial calculation to which you can then apply your own attitude and appetite to risk and arrive at a sound, and properly understood, commercial decision.

Negotiation Tool

Credit limits provide some great opportunities with your customers.

They can help build customer loyalty, present a point of differentiation from your competitors and help secure larger orders.

Setting a credit limit allows a point of negotiation in sales discussions and allows a further point of negotiation when your customer asks for their credit limit to be increased - something they can’t do if you don’t set them one!

When asked to increase a credit limit then this should absolutely be seen as an opportunity. But as with any opportunity, you must decide if it’s one you should take.

You need to understand why your customer needs to borrow more from you. And as a rule of thumb, If they are not looking to place more business with you, then what’s the point?

You should consider the request to be a sign of financial stress within the customer's business until you are convinced otherwise. And remember, high growth in a business eats cash, so even if they are growing fast, it doesn’t mean they are a safe bet.

Points you must consider:

- Why do they need to borrow more from you?

- Have they spoken to their bank (have they been declined)?

- Have they exhausted their credit elsewhere and can therefore, only buy from you?

- Have they had a financial shock (large bad debt, stock they can’t shift, business disruption)?

- Are they having cash flow difficulties, if so, what is causing them?

Running a credit check is an important and sensible step, but always remember that these reports are based on historic factors and may not be representative of recent events.

A 'yes' to any of the above doesn’t mean you have to give an instant 'no'. It simply means that your decision re. increasing your risk (which is a commercial decision) is based on an understanding of the situation.

And if your customer is in financial difficulty, you may well be able to help them through a tough period - a perfectly acceptable commercial decision provided you are aware of all the facts.

But remember - if you are extending credit terms, think about extending your own terms with key suppliers - remember the basic working capital calculation above.

Credit checking customers

Credit checking customers is a great way of getting a snapshot of their financial position and attitude to trade credit. But as said earlier, the results may not include recent events.

We are in favour of using a monthly subscription such as CreditFocus as the monthly subscription increases the likelihood of you credit checking customers regularly, rather than just at the outset of the relationship.

Our guidance is that you should credit check any business that will take up more than 2.5% of your total credit allowance, together with anyone you are uncertain about.

As a further buffer, and in order to encourage good behaviour in your customer base, we also suggest that you only advance a maximum of 75% of the maximum credit limit your credit checking service suggests.

This is on the basis that you will increase the limit up to 100% after 3 months of on time payments and/or minimum expected order levels being achieved.

Structuring your credit limits

Not all customers are the same so not all credit limits should be the same.

If you have a ‘flat’ credit limit (for example you have a policy of granting £2,500 to all customers) then you will absolutely be giving some customers too much credit, and others too little.

We suggest you start with a minimum order value for credit to even be an option (don’t forget that your customers can always pay by credit card if they need time to pay).

Next, and as mentioned above, you should start with a reduced level of credit ‘as policy’.

Never give the maximum amount of credit that you would be happy with to a new customer - give them a proportion of that limit, and use it as a negotiation tool as the relationship develops.

Have a link to payment terms - if a customer routinely pays ahead of term, consider rewarding them with an increased limit. Likewise, a customer who routinely pays late, don’t be afraid to reduce the limit.

Having a clear structure to how and when you grant credit has several benefits:

- You can’t be ‘ambushed’ by aggressive customers - you have a policy that you need to review before you answer their request.

- You can give a reasoned ‘no’ - you are able to explain your decision, and explain what the customer needs to do in order to ‘fix’ the reason why you can’t extend credit.

- You have an excuse to contact larger customers that you want to win more work from, using the credit limit policy as a basis for discussion.

And remember, above anything else, you can always choose to depart from any of your policies if your commercial decision is to do so. It’s your business!

Always make informed commercial decisions - not gut feel.

If you would like clear, concise and easy to understand help and advice on any issues that you are concerned about then you can contact us on 01474 326224. Alternatively, visit the website tweet @atnpartnership or email info@atnpartnership.co.uk.