As we covered in our blog ‘What you need to know - running your own company’, corporation tax is paid by limited companies and is based on their annual taxable profits.

It must be paid within 9 months of the company’s year-end, although, oddly, the tax return doesn’t need to be filed with HMRC until 12 months after the year-end. And yes, you read that correctly, the tax is payable before the tax return is due.

It’s also worth noting that in a company’s first year of registration it is likely that it will need to file two tax returns.

For the past few years, all UK limited companies have paid the same rate of corporation tax (19%) regardless of their size. Special provisions existed for companies involved in (broadly speaking) oil and/or gas extraction, but outside of these activities, there was one rate, keeping things unusually simple in the realms of UK tax.

From April 2023, a second rate will be introduced for companies with taxable profits of more than £50,000. Essentially, companies earning taxable profits of more than £250,000 will pay a corporation tax rate of 25%, and companies earning taxable profits below £50,000 will pay 19%.

Sadly, that’s where the simplicity ends.

If your company earns between £50,000 and £250,000 in taxable profits, then it will pay what is referred to as a marginal rate of corporation tax. And, due to the way the calculations work, this can mean that the company ends up paying a rate that is higher than the declared highest rate, of 25%.

(Note: we refer to taxable profits as these will often be different from financial or trading profits).

Marginal Small Companies Relief

Although we just said that companies earning taxable profits of below £50,000 will be taxed at 19% and those earning over £250,000 will be taxed at 25%, that isn’t entirely true.

Any company earning taxable profits of over £50,000 will be taxed at 25%.

If their taxable profits are between £50,000 and £250,000, they can then claim Marginal Small Companies Relief (MSCR) - these companies are in a position referred to as being in the ‘marginal range’.

MSCR adjusts the tax paid and reduces the overall tax rate. It is designed to graduate the increase in tax from 19% to 25% as business profits increase up to the £250,000 threshold.

However, complexities in the calculations mean that the marginal relief usually has the effect of actually increasing the rate of tax payable on profits that fall within the marginal range, to a rate that is higher than 25%.

So the maximum you can pay as a total percentage on all your profits is 25%, but you may well be paying a higher rate than this on any profits that fall between £50,000 and £250,000.

Although the maximum rate of corporation tax will be 25%, if you are in the marginal range, you may well find that you are paying an effective rate of almost 27% of company profits that exceed £50,000. To help explain this more clearly, please see the following example.

Example

If Company A has made a taxable annual profit of £150,000, then it will receive marginal relief of £1,500.

The tax on profits below £50,000 will be £9,500 at 19%, and the additional £100,000 of profits will result in an additional £26,500 of corporation tax (i.e., 26.5% corporation rate).

In the end, this means that the company will pay a corporation tax bill of £36,000 (£9.5k + £26.5k), which is equivalent to 24% of the total profit made by the company.

Associated Companies

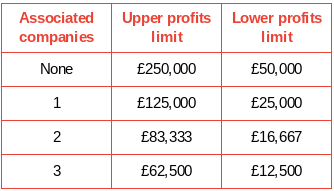

If a company has associated companies, this has an impact on the profit thresholds spoken about above, so the £50,000 lower limit and £250,000 upper limit reduce for each company.

Although each situation is different, broadly speaking, companies will be associated if:

- They are controlled by the same individual

- They are controlled by the same group of individuals

- They are family members and there is a commercial interdependency

HMRC can also look at aspects such as ‘negative’ control, where for example an individual may only have a 30% shareholding in a company, but guarantees the bank borrowing.

The impact of associated companies on the thresholds is as follows (for 0 - 3 companies):

If you have a situation where you think associated companies may be a factor, you need to plan to ensure that profits align as closely as possible. Contact us if you need further guidance.

The impact on dividends

The return of marginal rates (yes, they were a ‘thing’ years ago) means that what was reasonably straightforward salary/dividend planning, now needs more thought.

If your company profits will fall into a marginal band, it is something that you at the very least need to consider, particularly as a higher rate taxpayer, and less so if you are an additional rate payer.

So, are corporation tax rates going up?

The simple answer is, ‘only if your company will make £50,000 or more in taxable profits’.

Essentially:

- For profits over £250,000, the Main Rate of 25% applies to all profits – including those below £250,000

- For profits below £50,000, the Small Company Rate of 19% applies to all profits

- For profits between these thresholds, then the main rate of 25% applies and the company is entitled to Marginal Small Companies Relief (MSCR)

- Associated companies may have a significant impact on tax payments

Talk to us

If you would like clear, concise, and easy to understand help and advice on any issues that you are concerned about, then you can contact us on 01474 326224. Alternatively, visit our website, tweet @atnpartnership, or email us info@atnpartnership.co.uk.